The Driversnote automatic mileage tracker is an easy-to-use tool that helps individuals and businesses automatically track, manage, and categorize mileage for IRS compliant logbooks. It is suitable for anyone who needs to record business mileage, including self-employed individuals, employees, and businesses. The app offers automatic trip logging, customizable mileage logs, and the ability to track multiple vehicles and workplaces. The tool is also ideal for business reimbursement programs and includes a Teams solution to simplify company reimbursement. The app can be accessed from anywhere and supports numerous countries. Privacy is a key feature, as the company does not sell data and will never provide user information to other parties for marketing purposes. Customers can access support through the Assist Center or by contacting support via email or phone.

Automatically track, manage and categorize mileage for an IRS compliant logbook.Your easy-to-use mileage trackerSave time and maximize your mileage reimbursement or deductions with the Driversnote automatic mileage tracker.We’ll generate the compliant mileage logs you need for your IRS tax deduction or company reimbursement and keep your logs safe with the best mileage tracker.Join more than 1,500,000 drivers who use the Driversnote miles tracker for their business mileage reimbursement and deductions.

I have known chrome os for a long time, and I have always wanted to buy a chromebook.Suffering from

2023-03-13It is reported that Microsoft will launch new productivity applications for Android, iOS and its own

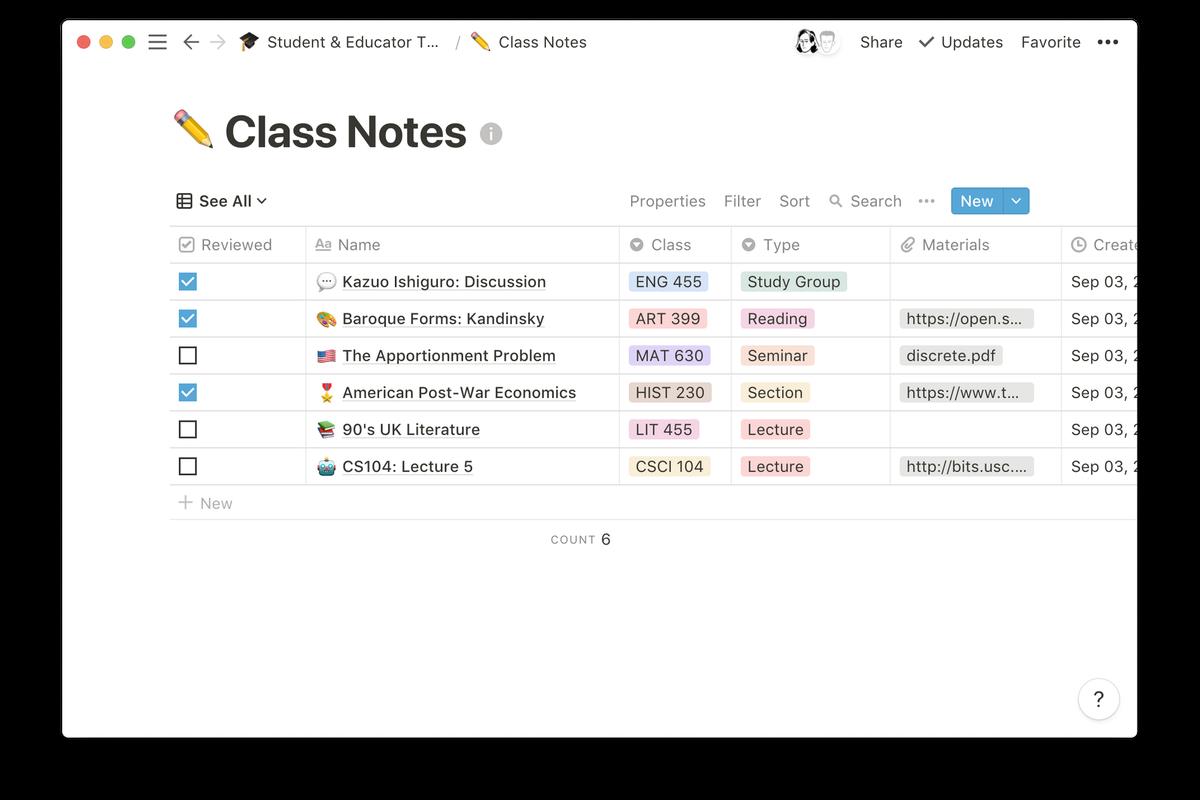

2023-03-13Notion is an application that provides components such as Notes, Tasks, Database, Kanban, Calendar a

2023-03-13The full text is 1409 words in total, and the estimated learning time is 5 minutesSource: unsplashYo

2023-03-13With the rapid spread of the new crown virus in the United States, more and more Americans are force

2023-03-13Divine Translation Bureau is a compilation team under 36 Krypton, focusing on technology, business,

2023-03-13